How International Organizations are Changing Transfer Pricing Compliance

Transfer pricing is becoming more and more of a priority in the tax world. Over the past few decades, it has grown in importance to tax authorities, and international organizations have helped develop a global transfer pricing order.

Today, the input of the OECD, European Union, United Nations, the Pacific Association of Tax Administrators (PATA), and African Tax Administration Forum (AFTA), can be seen in transfer pricing legislation all over the world.

So, it’s worth monitoring the movements of these international bodies as tax authorities utilize their reports and introduce them into local tax laws. Here, we discuss the role these groups play in the transfer pricing world.

The OECD

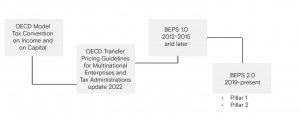

Publications: The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (first edition in 1979 and the latest edition in 2022) and the comprehensive BEPS project have become the foundation of transfer pricing compliance. In addition, there’s the OECD’s Model Tax Convention on Income and on Capital, which covers the issue of double taxation due to transfer pricing.

Over time, OECD Guidelines have become a reference point for tax administrations not only in OECD member countries, but in other jurisdictions as well. The OECD’s work on transfer pricing is ongoing—in addition to the 2022 OECD Guidelines, detailed reports are often issued, including “Guidance on the Transfer Pricing Implications of the Covid-19 Pandemic.”

Action on Base Erosion and Profit Shifting (BEPS):

BEPS 1.0: In effect from 2012 to 2015 and launched by the G20, BEPS 1.0 included 15 actions—steps that individual countries were encouraged to take to prevent tax avoidance through profit shifting. BEPS 1.0 resulted in profit allocations to be increasingly aligned with value creation, with more earnings taxed in countries with more decision-making substance.

BEPS Actions Plans: The OECD’s 15 BEPS action plans offer guidance on everything from tax challenges arising from digitalization to the prevention of treaty abuse. However, several are devoted solely to transfer pricing:

BEPS Action 8-10: These actions address transfer pricing by offering guidance on applying the arm’s length principle and its relationship to value creation. These transfer pricing-related actions are explained in the report “Aligning Transfer Pricing Outcomes with Value Creation.”

BEPS Action 13: The OECD offers guidance on the minimum standard of transfer pricing documentation in BEPS Action 13. This guidance introduces three-tier transfer pricing documentation in the form of the master file, local file, and the country-by-country report. Transfer pricing documentation is also explained in the OECD’s report “Guidance on Transfer Pricing Documentation and Country-by-Country Reporting.”

New Reports: The OECD monitors the changing tax and transfer pricing environment and issues new reports as needed.

Permanent Establishments: Additional guidance on the attribution of profits to permanent establishments resulting from the changes in the “Additional Guidance on the Attribution of Profits to Permanent Establishments” (March 2018) is a report pertaining to BEPS Action 7 and the definition of a permanent establishment as defined in Article 5 of the OECD Model Tax Convention.

Profit-split Method: The OECD revised guidance on transactional profit split method (Action 10, June 2018).

Hard-to-Value Intangibles: Additional guidance addressed an approach to transactions involving hard-to-value intangibles (HTVI) (June 2018).

Financial Transactions: New transfer pricing guidance on financial transactions addresses Actions 4 and 8-10 (February 2020) and was later incorporated into the OECD’s transfer pricing guidelines.

BEPS 2.0:

The next OECD project pertaining to transfer pricing is BEPS 2.0, a response to the digitalization of the economy. In January 2019, the OECD issued a policy note introducing a two-pillar approach. Pillar One covers profit allocation issues in the context of digital business activity to ensure that MNEs pay a fair share of tax wherever they operate. Pillar Two addresses broader BEPS issues and may result in an international minimum taxation.

BEPS 2.0 is designed to attribute more value from remote business activity to the markets involved, allocating a larger share of profits based on the customer base in various locations.

As of November 4, 2021,137 countries and jurisdictions agreed to the two-pillar plan as a solution to aligning international taxation rules with the digital world.

The European Union

In the European Union transfer pricing developments are managed by:

- Transfer Pricing and the Arbitration Convention: This EU instrument works to eliminate double taxation in connection with the adjustment of profits of associated enterprises.

- EU Joint Transfer Pricing Forum (JTPF): Created by the European Commission in 2002, the EU Joint Transfer Pricing Forum works to reduce high compliance costs and to avoid (or facilitate the elimination of) double taxation that easily arises in the case of cross-border, inter-group transactions.

The works of EU Joint Transfer Pricing Forum has resulted in the Code of Conduct on transfer pricing documentation for associated enterprises in the European Union (2006).

JTPF has contributed numerous reports including:

- Report on the application of the profit split method within the EU (March 2019)

- Report on a coordinated approach to transfer pricing controls within the EU (October 2018)

- The Report on the Use Application of Economic Valuation Techniques in Transfer Pricing (September 2017)

- Report on the Use of Comparables in the EU (March 2017)

- Study on Comparable Data Used for Transfer Pricing in the EU (December 2016)

- Study on the Application of Economic Valuation Techniques for Determining Transfer Prices of Cross Border Transactions between Members of Multinational Enterprise Groups in the EU (December 2016).

United Nations

The United Nations issued the “UN Practical Manual on Transfer Pricing for Developing Countries” (first edition in 2013, updated in 2021) as well as the “UN Model Double Taxation Convention between Developed and Developing Countries” (updated in 2021).

It should be noted that the UN Model Convention generally favors the retention of greater host country taxing rights, and it tends to be relied upon by developing countries more than the OECD Model Tax Convention on Income and on Capital.

The United Nations also established the Committee of Experts on International Cooperation in Tax Matters. The Committee of Experts examines also transfer pricing in terms of mutual collaboration and assistance in collection of debts and also, protocols for the mutual agreement procedure, treaty shopping and treaty abuses, interaction of tax, trade, and investment, financial taxation and equity market development, tax treatment of cross-border interest income and capital flight and taxation of electronic commerce.

Recently, the UN Committee has reportedly approved a workplan for the development of a multilateral approach to implement Article 12B, Income from Automated Digital Services, of the UN Model Convention.

This would involve the use of a multilateral instrument similar to that developed by the OECD to implement BEPS changes to the OECD Model Convention.

The Pacific Association of Tax Administrators (PATA)

PATA delivers transfer pricing works tailored for Australia, Canada, Japan, and the United States. The group provides principles under which taxpayers can create uniform transfer pricing documentation (“PATA Documentation Package”), so that one set of documentation can meet their respective transfer pricing documentation regulations.

This documentation package is considered to be consistent with the general principles outlined in Chapter V of OECD Guidelines.

African Tax Administration Forum

Since 2016, ATAF has provided transfer pricing technical assistance to members. These projects help African tax administrations build their transfer pricing audit expertise and update their transfer pricing legislation to diminish profit shifting and provide greater tax certainty.

As transfer pricing continues to be a focal point in the international tax world, it’s important to stay abreast of new regulations issued by local tax authorities.

However, it’s just as important to tune into the organizations that guide those tax authorities as their next moves will eventually trickle down into the local laws that reach your tax department. These organizations may not have governing power, but that’s not to say, they don’t have any power at all.