Claim with Confidence

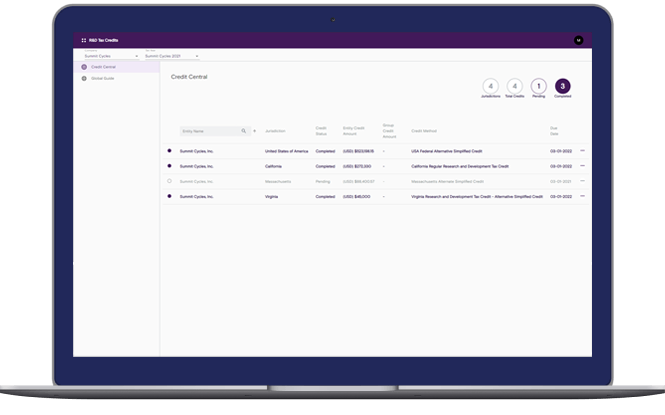

Exactera combines R&D tax credit software with a team of knowledgeable experts to streamline the application process and calculate U.S. federal and state credits. The result? You can apply for the credit with confidence—and reap the most reward.