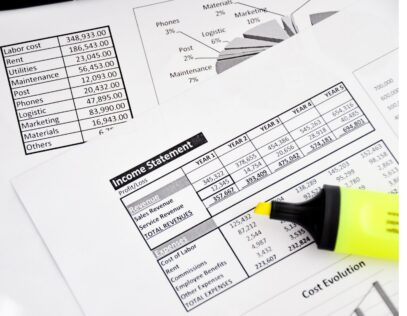

Chances are you have just recently completed your annual corporate income tax provision. If you’re like most companies and execute the calculation using Excel, the process was probably time consuming, stressful, and cumbersome. It’s enough to make you wonder if you’re using the right tool for the job.

Sorry to be the one to tell you this, but the answer is no. Few, if any, tax departments stay with Excel because of its mind-blowing capabilities. The program is clunky and way too unsophisticated for today’s hawkish tax scrutiny and complex business world. Still, tax departments cling to it because they don’t want to invest in complicated technology that will be hard to implement and even harder to use.

That leaves you in a rather precarious position. In a 2022 Thomson Reuters survey, 57% of tax department employees said they didn’t have the resources they need to do their jobs. A lack of resources—be it short staffing or foregoing modern-day technology—can lead to shortcuts on the income tax provision, maybe plugging rate reconciliations or not proving out deferreds, making a company’s most important calculation prone to error. On the income tax provision, that’s simply not an option.

An Alternative To Excel’s Limitations Or Clunky, Difficult Software Solutions

We talk to tax professionals all the time and hear about their experiences—how they want to be more efficient, balance their journals seamlessly, and have more ownership of their data. Software has been developed by many companies to try and bridge these gaps but until recently, these solutions, with their lengthy implementation cycles and difficult user experiences merely replaced one kind of frustration with another.

Today, Exactera proudly announces the launch of our next generation tax provision software solution: Exactera Tax Provision. We took early customer feedback, surveyed the software landscape and created a modern, user-friendly alternative to complex provision software solutions. And in terms of automation and efficiency, it’s lightyears ahead of Excel.

So, what do we mean by “modern”? We mean shaving weeks off the time it takes you to prepare your tax provision. We mean being able to trace back calculations to their source, with the click of a mouse as opposed to spending hours poring over spreadsheets. We mean having visibility through dashboards that you can present to executives and automating time-consuming tasks, like proving out deferreds. But most of all, we mean control—complete ownership over your data and insight into the numbers and the story they’re telling.

Gamechanging Tax Superpowers

A few superpowers never hurt either. After all, the demands on today’s tax departments far exceed tax, and the department, no matter how under-resourced, must be ready. Exactera Tax Provision has you covered. When business looks to the tax department to see what would happen to the ETR if they did X or if they tried Y, our software’s ETR Analyzer delivers the answers. When the C-suite wants to know how this year’s ETR compares to the prior year, enter a few dates and the Trend Analyzer will produce reports that compare one provision period to another.

Our software offers swift implementation and it’s user-friendly. In fact, our customers are able to use Exactera Tax Provision after just one hour of training. “If I can do it, anyone can,” says Andrea Evans, the tax manager at Roseburg Forest Products, who executed her 2022 annual income tax provision using the new technology.

We invite you to see how a modern approach can take the tediousness—and stress—out of your tax provision calculation by joining our webinar, live today at 2pm ET/11 am PT or later on-demand. Don’t get left behind—request a demo today.