Comparability Analysis Under OECD Guidelines and Section 482

January 21, 2025 11:00am ETArm’s length transfer pricing is based on comparability, but even the OECD Transfer Pricing Guidelines and US Sec. 482 regulations recognize that “perfect” comparables rarely, if ever, exist. Transfer pricing professionals must evaluate and measure comparability factors to determine whether they are material and, if differences exist, whether they can make a defensible adjustment.

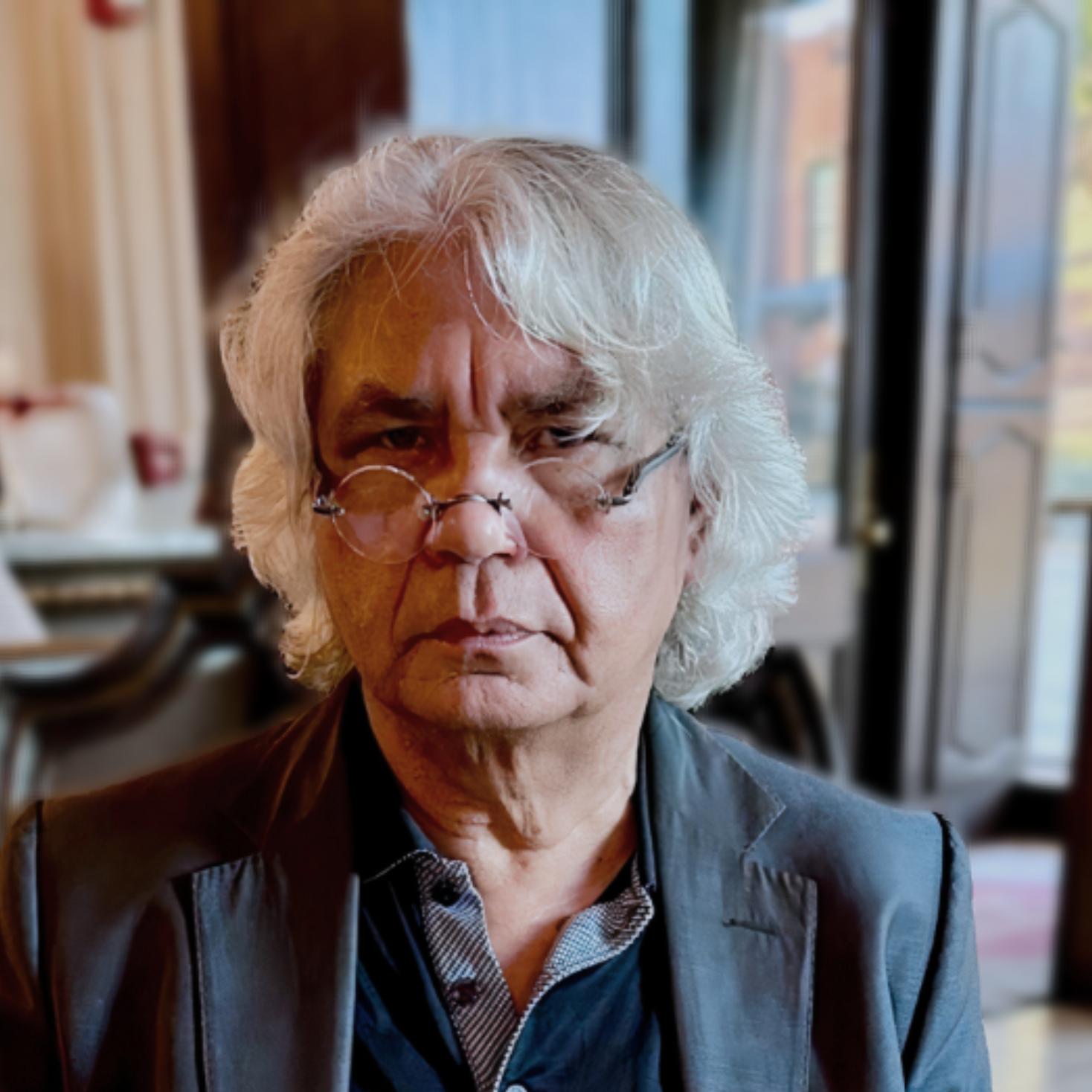

In this enlightening webinar, world-renowned transfer pricing economist Ednaldo Silva Ph. D. and Spencer Ho, a specialist at RoyaltyStat, an Exactera Company, discuss key elements of defensible comparability analysis. Join us to learn about the various factors that impact comparability and how to prioritize them, the importance of reliable data, and when and how to apply sound comparability adjustments.