Shareholders, prospective investors, and market analysts are keenly interested in the financial performance of publicly traded companies.

Understanding the fiscal health of a business provides these interested parties the insights they need to make strategic decisions. U.S. publicly traded entities (along with many private and foreign publicly traded entities) must produce mandatory quarterly and annual financial statements, which provide this information.

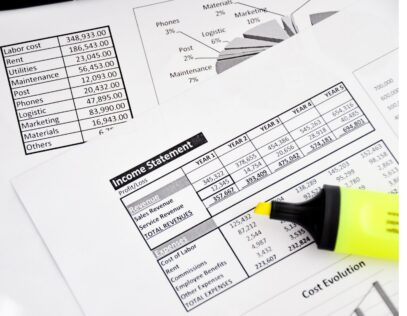

Financial statements are comprised of three primary reports: an income statement, a balance sheet, and a cash–flow statement. The income statement includes the amount of revenue and expenses accumulated for the period.

The balance sheet includes the amount of assets, liabilities, and shareholder’s equity on hand at period end. And the cash–flow statement includes the amount of cash inflows and outflows in terms of operating, investing, and financing activities.

One key element of both quarterly and annual financial statements is the impact of income tax on a company’s performance. The calculation of the collective effect of income tax on a company’s financial statement is referred to as an income tax provision, or simply “tax provision.”

Moving Parts

So, why is the income tax provision so important? The tax provision directly affects a company’s earnings, along with its assets/liabilities profile. The higher the tax provision, the lower a company’s earnings. The lower the tax provision, the higher a company’s earnings. Given that this computation has such an impact on a company’s financials, tax provisions receive a great deal of scrutiny.

Internal stakeholders–namely the CFO and other members of the C-suite—along with shareholders, prospective investors, market analysts, and creditors examine the results to assess the company’s true financial position.

Meanwhile, external stakeholders—financial statement auditors (i.e. public accounting firms) and regulators—study the tax provision to ensure it’s accurate and in compliance.

A company’s tax department essentially requires complete financial statement data (e.g. a full income statement and balance sheet, excluding the income tax pieces) before they can perform the tax provision calculations, and the tax department is often left waiting for financial accountants to close the “pre-tax” books to begin the work.

In other words, the tax provision is the finale of the accounting process.

The first key product of the tax provision is the income tax expense (or benefit) included on the income statement. The next are the income tax payable (or receivable) and deferred tax asset (or liability), which are calculated on the balance sheet.

Then, once all these items are calculated, you can compute a company’s effective tax rate (ETR), which is a key disclosure in the supporting notes to the financial statements — and is calculated based on dividing the income tax expense (or benefit) by “pre-tax” income, or income before income taxes.

The ETR is arguably the most important output of the calculation and is really where the rubber meets the road when it comes to a tax provision.

This is because this measure indicates if a company is operating in a tax-efficient manner—and is a widely utilized benchmark for companies, to both evaluate the tax function’s performance internally (e.g. quarter-over-quarter or year-over-year) and externally (e.g. versus competitors and peers). When it comes to tax, the ETR tells a company’s story.

The Challenges

Given the scope of the tax provision and the stakeholders involved, the calculations come with substantial challenges.

First, the computations must be accurate. If not, a company could face the consequences of financial statement auditors finding an error – which can result in misstated financial statements leading investors astray and even legal action.

Second, the income tax provision calculations must be completed expeditiously. Most companies must file their quarterly and annual financial statements shortly after the end of the relevant period. As the income tax provision is the final step in the accounting cycle, this is generally subject to the tightest time crunch of all.

On the quarters, it’s not unusual for companies to have only 1-2 days to compute the income tax provision; while, year-end is not much better, with many companies only having a week to perform the tax calculations.

Late filings are not an option for public companies—as potential consequences include significant negative effects on stock price and even delisting from applicable stock exchanges. Private companies also face pressure to promptly file, as not doing so can have severe repercussions from shareholders and creditors.

Third, the tax provision should provide value for a company above and beyond merely providing the required outputs. The tax provision should offer insights into past performance and help plan for the future.

The consequences of not doing this are less intuitive to the others – here, the impact may include a tax department not effectively identifying money-saving opportunities or spotting trends, which could result in an unsatisfied C-Suite (and the repercussions that go along with it) and an increased ETR or additional tax liabilities.

The Need for Technology

So, with all this information, you may be asking yourself how you prepare an income tax provision that is accurate so that it passes an auditor’s inspection of the financial statement? How do you do it to meet, or even exceed your strict, breakneck deadline? And how do you take your provision to that next level through analytics?

The process has largely been dominated by companies using Microsoft Excel–where many tax professionals still feel most comfortable operating. However, Excel doesn’t solve any of these problems. By its nature, Excel is manual, prone to error, and it can include inconsistent data.

Further, given Excel’s inability to automate and lack of flexibility in terms of adjusting to changes in a company’s structure or accounting records, completing a tax provision in Excel is highly inefficient and time-consuming.

Lastly, Excel doesn’t easily provide analytical insights into results, potentially leading to missed opportunities and disappointed stakeholders.

Tax provision software, on the other hand, can save tax departments time, enhance accuracy, capitalize on opportunities, and turn the output into something valuable to decision-makers in the organization.