Exactera Unveils Exposed Formula Exports Feature to Enhance Efficiency and Visibility in Tax Provision Calculations

New software capability offers insights into the tax provision calculation, making the process more efficient and reports more transparent for taxpayers and auditors alike.

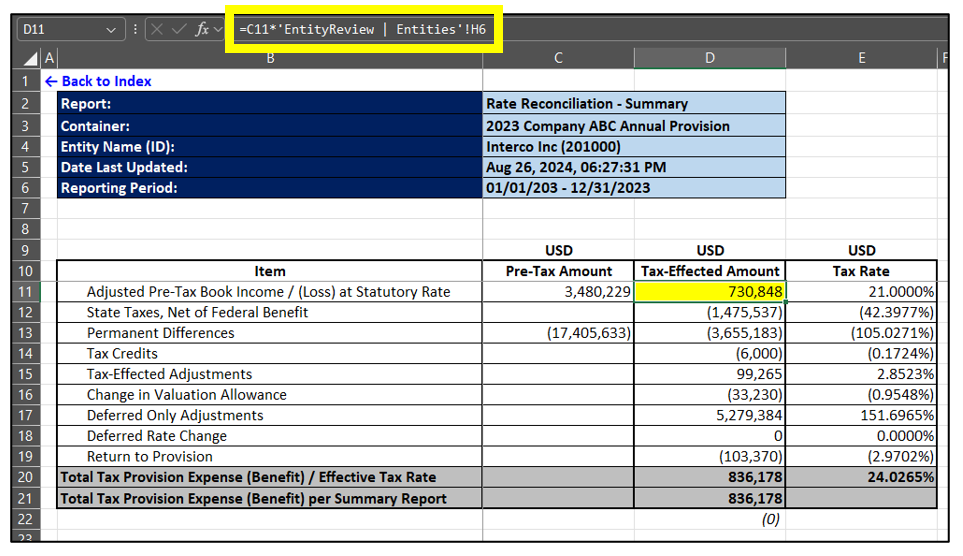

Tarrytown, NY – December 3, 2024: Exactera, a global provider of technology-driven tax compliance solutions, announces the addition of Exposed Formula Exports, a new capability in Exactera Tax Provision, which enables users to view calculation formulas on downloaded Excel-based reports. This calculation transparency allows taxpayers to follow the flow of data between reports seamlessly and enables auditors to efficiently see how amounts were calculated during their reviews.

“Exposed Formula Exports allows taxpayers to self-review their tax provision calculation with unprecedented clarity,” says Xander Jones, Exactera’s director of tax provision professional services. “This innovative tool allows users to track computation formulas in real-time, significantly enhancing accuracy and reducing errors before audits. Visibility into calculations frees up valuable time for strategic analysis rather than tedious data reconciliation. It’s a significant leap forward in tax provision preparation and audit review.”

The ability to see calculation formulas on downloaded reports empowers taxpayers to catch mistakes early in the provision process. It also enables them to answer auditors’ questions quickly during audit reviews, saving time and money throughout the process. Exposed Formula Exports also offers transparency by allowing taxpayers to view local currencies and U.S. dollars on the same report instead of running multiple reports for every country where companies have operations.

With Exposed Formula Exports, users can:

- Reduce audit prep and provision completion time, allowing time for high-value activities like analyzing results and strategic planning.

- Enhance internal review efficiency.

- Gain deeper visibility into data.

- Calculate a more transparent, efficient, and accurate tax provision.

“Transparency is essential throughout the provision process, especially given the complexities of calculating the income tax provision under ASC 740,” says CEO Michael Hickman. “We’re excited to offer enhanced reporting capabilities in Exactera Tax Provision that empower tax professionals with visibility into their calculations and deeper insights into their businesses.”

To schedule a tour of Exactera Tax Provision’s Exposed Formula Exports, visit https://exactera.com/exposed-formula-exports-speak-to-a-provision-expert/.

About Exactera

Exactera is a leading provider of corporate tax compliance solutions for transfer pricing, tax provision, and R&D tax credits. Leveraging premium data and innovative AI models, Exactera helps tax professionals be more efficient, mitigate risk, and streamline compliance through consistent and diligent documentation processes, all with accuracy and peace of mind. Headquartered in the United States, Exactera serves hundreds of customers across the globe, including some of the world’s best-known brands. For more information, visit exactera.com.