What is Other Comprehensive Income?

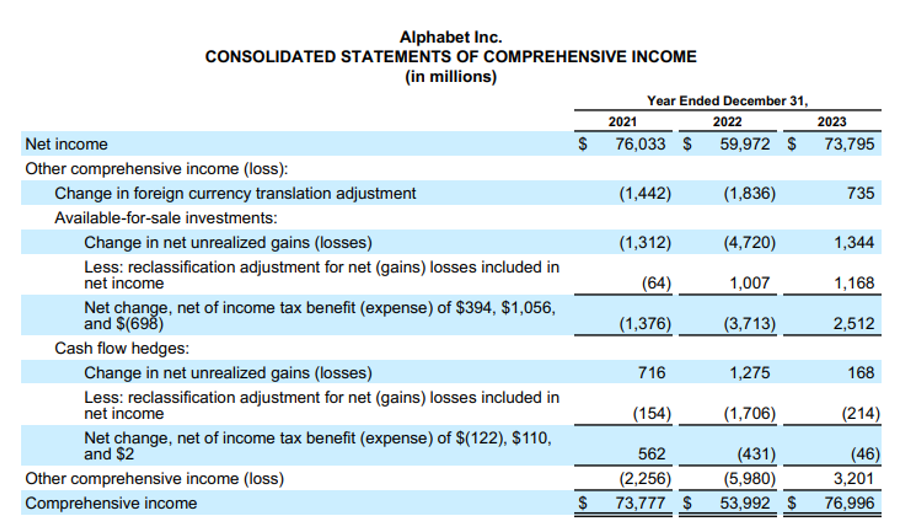

Other Comprehensive Income (OCI) is a section of the income statement that includes items that are not recognized in net income but are still significant to understanding the financial performance of a company. OCI items are typically non-cash items that have a significant impact on a company’s equity. Examples include unrealized gains or losses on available-for-sale securities, foreign currency translation adjustments, pension-plan adjustments, and changes in the fair value of derivative instruments.

OCI items are recognized in the income statement as OCI, not in net income. Companies are required to disclose the components of OCI and the related tax effects in their financial statements. OCI provides investors with a more comprehensive view of a company’s financial performance by including items that are not recognized in net income. This information can clarify the company’s long-term financial health and prospects.

How is OCI Disclosed in Financial Statements?

OCI is typically reported in the income statement as a separate section below net income, as shown below. This section will include the various components of OCI.

In addition to the income statement, OCI is also disclosed in the footnotes of the financial statements. The footnotes will provide more detailed information about the components of OCI, including: the nature of the OCI items, the amount of each OCI item, the tax effects of OCI items, and the reasons for any significant changes in OCI items from the prior year.

The footnotes may also include a reconciliation of the beginning and ending balances of OCI, which shows how the balance of OCI changed during the year.

How Is OCI Treated for The Income Tax Provision?

Generally, OCI items are not subject to current income tax, only deferred income tax. Some key points to consider include:

- Taxable vs. Tax-exempt OCI:

- Taxable OCI: Items that will eventually be recognized in taxable income, such as unrealized gains on available-for-sale securities, are deferred for tax purposes until realized.

- Tax-exempt OCI: Items that will never be recognized in taxable income, such as pension plan adjustments, are not subject to income tax.

- Deferred Tax Liabilities and Assets:

- Deferred Tax Liabilities: These arise when taxable income is greater than accounting income due to temporary differences. They are recorded as liabilities on the balance sheet.

- Deferred Tax Assets: These arise when accounting income is greater than taxable income due to temporary differences. They are recorded as assets on the balance sheet.

- The amount of deferred tax liabilities and assets is calculated based on the difference between the tax basis of assets and liabilities and their carrying amount on the balance sheet.

- Tax Effects of OCI:

- Tax effects of OCI items are typically recognized in the income statement as adjustments to income tax expense. This is because OCI items represent future taxable or tax-exempt events.

- The tax effects of OCI items can be significant, especially for companies with large amounts of OCI.

- Disclosure Requirements:

- Companies are required to disclose the components of OCI and the related tax effects in their financial statements. This helps investors understand the potential future tax implications of OCI items.

ASC 740, the accounting standard for income taxes in the United States, requires companies to:

- Recognize the tax effects of OCI items in the income statement.

- Measure the tax effects of OCI items based on the enacted tax rates applicable to the year in which the OCI items are expected to be recognized in taxable income.

- Disclose the components of OCI and the related tax effects in the financial statements.

This ensures that the financial statements provide a complete picture of the company’s income tax expense and the potential future tax implications of OCI items.

Overall, the interaction between OCI and the corporate income tax provision is a complex topic that requires careful consideration. Understanding the tax implications of OCI items is crucial for accurate financial reporting and effective tax planning.