Claim with Confidence

Canada’s unique Scientific Research & Experimental Development (SR&ED) Tax Credit is a generous annual tax credit that can equal up to 68% of all qualifying R&D expenses for Canadian Controlled Private Corporations (CCPC) and up to 45% for non-Canadian-controlled (or public) companies.

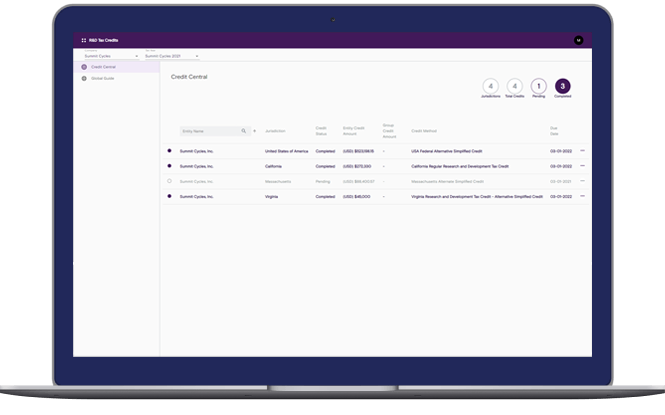

Applying for the SR&ED credit is easier and more affordable than you think—if you enlist the help of efficient, knowledgeable specialists. Exactera’s R&D tax credit experts streamline the application process and calculate Canada’s R&D tax credits to the specifications of the CRA. The result? You can apply for the credit with confidence—and reap the most reward. Unlike traditional consultants, our pricing is transparent—there are no hidden fees.

Let’s talk. Schedule a call with us today.